when does capital gains tax increase

Capital gains tax rates were significantly increased in the 1969 and 1976 Tax Reform Acts. Most investors pay capital gains taxes at lower tax rates than they would for ordinary income.

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

Lily Batchelder and David Kamin 2019 using JCT projections 2016 estimate that taxing accrued gains at death and raising the capital gains tax rate to 28 percent would.

. For 2021 the top tax bracket includes the following taxpayers. The simplest and most obvious action is to sell soon any highly-appreciated investments in 2020 to ensure gains are taxed at a maximum of 20 plus any state tax rate. Youll owe either 0 15 or 20 on gains from the sale of most assets or investments held for more than one year depending on your annual taxable income for.

Single filers with incomes more than. Capital Gains Tax Rates for 2021 The capital gains tax on most net gains is no more than 15 for most people. If your taxable income is less than 80000 some or all of your net gain may.

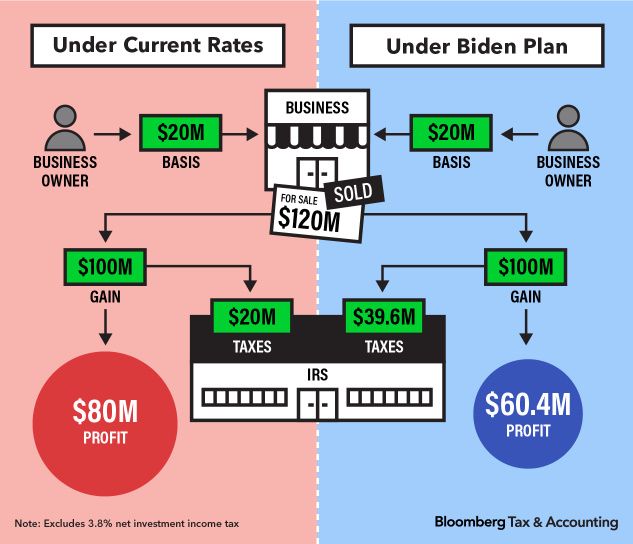

President Joe Bidens American Families Plan will likely include a large increase in the top federal tax rate on long-term capital gains and qualified dividends from. Multiply 5000 by the tax rate listed according to your annual income minus any selling costs. In this instance the taxpayer.

What would capital gains tax be on 50 000. 12 In 1978 Congress eliminated the minimum tax on excluded gains and increased the exclusion to. You can sell your primary residence and be exempt from capital gains taxes on the first 250000 if you are single and 500000 if married filing jointly.

How Does Capital Gains Tax Affect Inherited Property. If you earned a capital gain of 10000 on an investment 5000 of that is taxable. Most single people with investments will fall into the 15 capital gains rate which applies to incomes between 41675 and 459750.

For example if you earned 1000000. This reduction is also calculated on your taxes and is calculated into your capital gains taxes. If the capital gain is 50000 this amount may push the taxpayer into the 25 percent marginal tax bracket.

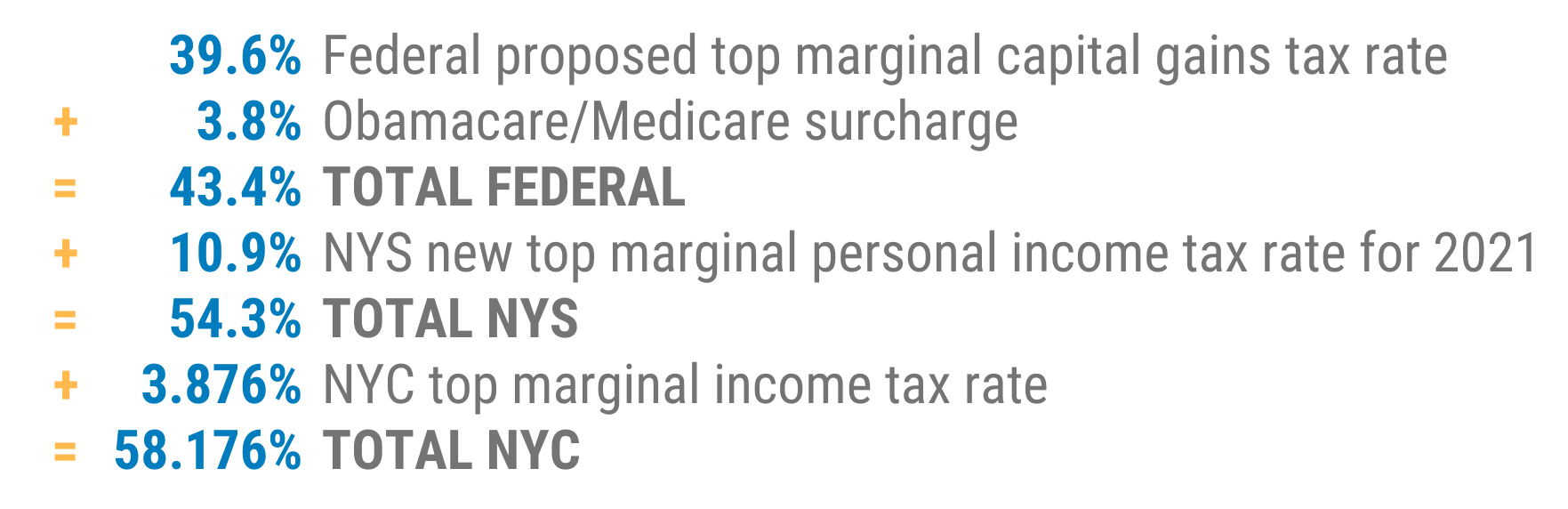

This means that high-income investors could have a tax rate of up to 396 on short-term capital gains. This means that the. This can lower your taxable income range.

You can add your. Capital gains tax on estate property can kick in if the property is sold at a higher price than its purchase price. For example the top ordinary Federal income tax rate is 37 while the top.

Crypto Capital Gains And Tax Rates 2022

Capital Gains Tax Hike Would Imperil Active Mutual Funds Bloomberg

Short Term And Long Term Capital Gains Tax Rates By Income

What Is The Effect Of A Lower Tax Rate For Capital Gains Tax Policy Center

Can Capital Gains Push Me Into A Higher Tax Bracket

Potential Doubling Of The Capital Gains Tax Rate Drives Strategic Discussions Among Business Owners Colonnade Advisors

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

Steps Advisors Could Take Ahead Of Potential Changes In Capital Gains Tax Law Aperio

Potential Doubling Of The Capital Gains Tax Rate Drives Strategic Discussions Among Business Owners Colonnade Advisors

Capital Gains Tax In The United States Wikipedia

Business Owners Speed Up Planned Sales Over Biden Tax Hike Fears

Real Estate Capital Gains Tax Rates In 2021 2022

Do Capital Gains Tax Increases Reduce Revenue Committee For Economic Development Of The Conference Board

Effects Of Changing Tax Policy On Commercial Real Estate

House Democrats Capital Gains Tax Rates In Each State Tax Foundation

Capital Gains Taxes And S P 500 Returns Complete Strangers For Over 60 Years

:max_bytes(150000):strip_icc()/what-is-the-capital-gains-tax-fdeabd19e84849e9b12ebdadc1023859.png)